For about the last week, there have been a lot of rumors about General Motors in China. These suggest that GM will retrench its operations in the Middle Kingdom and will sell the Buick brand to SAIC. However, the GM joint venture is not SAIC’s only problem, as evidenced by the 37.16% year-on-year drop In sales in July – a drop shared by almost every major business unit and not just the joint ventures. Furthermore the drop is not just symptomatic of the switch from ICE to new energy vehicles with NEV sales also declining.

Sales at the GM joint venture saw the greatest drop with a fall of 82.42% and the sales for the year so far are down 55.14%. This stands in stark contrast to the performance of SAIC’s other main joint venture with Volkswagen. Although July was a black spot with a decline of 18.18% the overall decline for the year is negligible at just 1.53%.

| Unit | July 2024 | July 2023 | Change | Jan-July 2024 | Jan-July 2023 | Change |

| Shanghai Volkswagen | 81,003 | 99,003 | -18.18% | 593,091 | 602,292 | -1.53% |

| Shanghai GM | 15,000 | 85,301 | -82.42% | 240,579 | 536,259 | -55.14% |

| SAIC passenger vehicle division | 50,279 | 71,771 | -29.95% | 385,118 | 482,570 | -20.19% |

| SAIC – GM -Wuling | 76,000 | 111,300 | -31.72% | 646,009 | 631,400 | 2.31% |

| Maxus | 14,336 | 18,700 | -23.34% | 110,612 | 124,708 | -11.30% |

| IM Motor | 4,180 | 1,722 | 142.74% | 26,632 | 11,512 | 131.34% |

| SAIC Motor Corporation Limited | 2,213 | 2,170 | 1.98% | 16,177 | 10,686 | 51.38% |

| SAIC – GM – Wuling Indonesia | 1,706 | 2,045 | -16.58% | 11,741 | 11,999 | -2.15% |

| MG Motors India | 4,575 | 5,022 | -8.90% | 29,515 | 37,245 | -20.75% |

| Other | 2,192 | 3,170 | -30.85% | 18,964 | 23,174 | -18.17% |

| Total | 251,484 | 400,204 | -37.16% | 2,078,438 | 2,471,845 | -15.92% |

| NEVs among them | 71,106 | 90,987 | -21.85% | 532,133 | 463,089 | -15.92% |

| Exports and overseas sales | 81,766 | 97,070 | -15.77% | 569,634 | 630,494 | -9.65% |

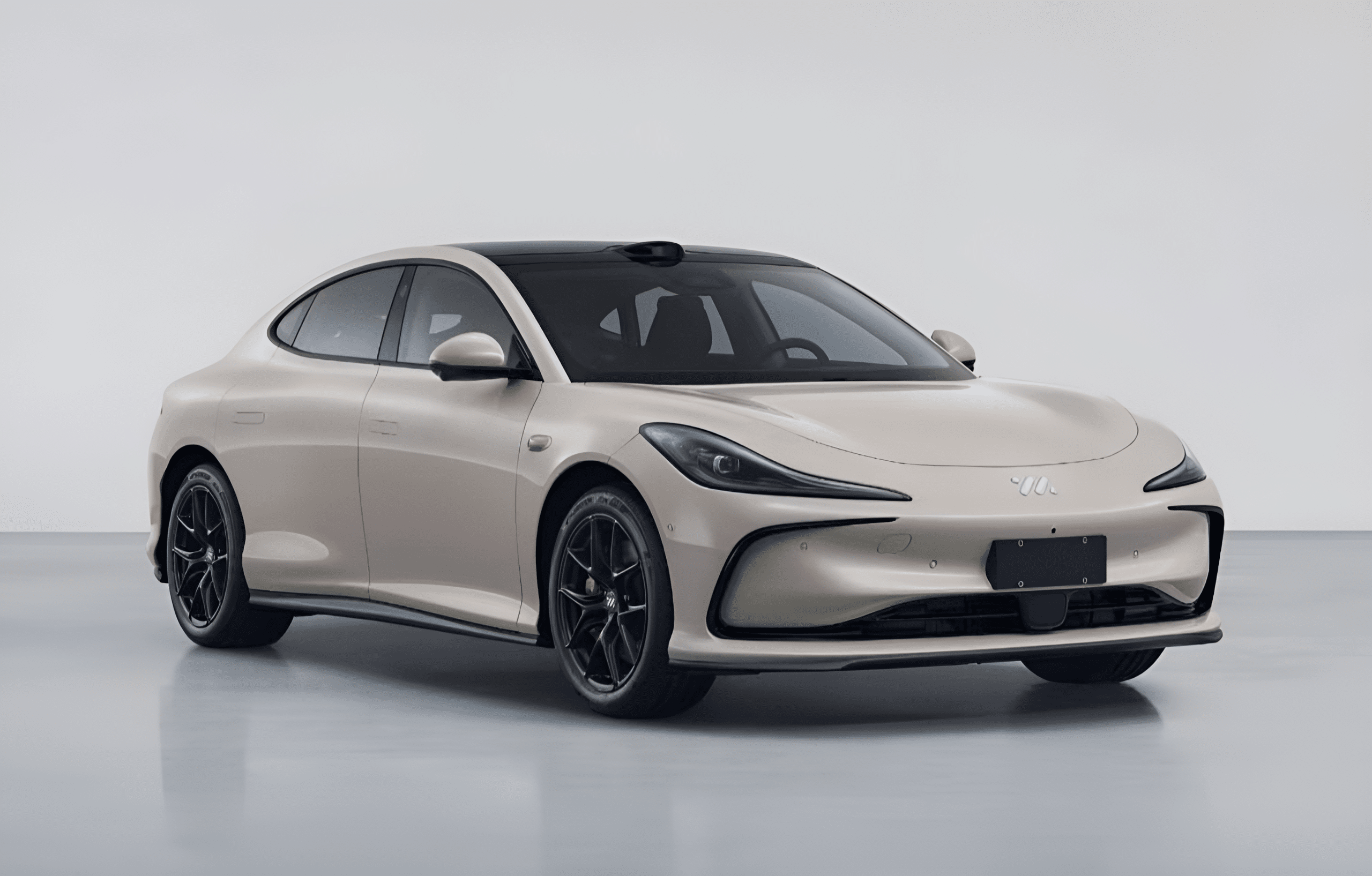

The Volkswagen joint venture fared much better than most of SAIC’s own brands. SAIC Motor’s passenger vehicle division, which is made up of the MG, Roewe, and Rising brands so far this year has sales down by 20.19% and in July saw a 29.95% decrease. Both the Maxus and IM brands are reported separately. Maxus fared nearly as badly, with a 23.34% year-on-year decline for July, but the reduction is a more modest 11.30% for the year so far. The IM brand is one of the few bright spots for SAIC. July sales were up by 142.74%, but at just 4,180, they hardly make much difference to the overall figure for SAIC. It should be noted that July’s performance for IM is very much in line with the brand’s performance so far this year, which has seen an increase of 131.34%.

Going forward, SAIC will be increasingly reliant on the GM Wuling joint venture. Sales for the year so far are 646,009 cars, an increase year on year of 2.31, and now account for the largest single share, with the only other unit coming close being Volkswagen. Even though the performance for the year so far is up, July sales for the unit were down and by one of the larger percentages at 31.72%.

The problem does not just lie with domestic sales; both the Indonesian branch of the Wuling JV and the Indian branch of MG experienced drops not only in July but also for the year as a whole. The total figures for both these branches are not particularly significant but what is more worrying is that the overall figure for exports and overseas business have seen a significant decline at 15.77% year-on-year for July and 9.65% for the year so far. This indicates that the problem is far more deep-rooted than a reduction due to the implementation of EU tariffs on EV imports in July.

What shows SAIC’s problems more than anything else is the figures for new energy vehicles. Last month, retail sales of new energy vehicles broke the fifty percent barrier for the first time with a figure of around 51%. What we see with SAIC is a decline of 21.85% during July for new energy vehicles, although sales for the year are up by 14.91%. A crude penetration figure purely based on total sales and not excluding exports is 28.2%, clearly well below the general level of the Chinese market – the percentage for the year to date is even worse at 25.6%.

There currently appears to be a rot setting in at SAIC. The 2023 annual report showed operating income had increased by 0.72%, but net profit was down by 12.48%, and sales were down on 2022 levels. Sales are obviously further down this year, and first quarter figures for operating income were down 1.95%, and there was a 2.48% year-on-year decline in net profit.

SAIC in 2023 implemented a three-year action plan for the development of new energy vehicles. Under the plans, the sales target for 2025 is 3.5 million new energy vehicles, but in the first seven months of this year, the sales only amounted to 532,133. If it is to achieve anywhere near such a target for next year, SAIC needs to sell far more. The company is also aiming to stem the decline in ICE sales.

Editor’s note:

On the face of it SAIC‘s number one problem is its inability to pivot to new energy vehicles successfully. There are, though, other problems that are perhaps not as obvious. Firstly SAIC is now very much dependent on the Wuling joint venture as its number one sales generator. The problem with this is that the brand specializes in cheaper vehicles, which will restrict profits. Being a joint venture these profits will have to be shared with the other partners although in the case of this JV SAIC has the controlling 50.1%. Ultimately SAIC needs to be less dependent on joint ventures and more self-sufficient which is why the decline in sales of the company’s own brands, with the exception of IM, is all the more worrying.

Source: Fast Technology

This was a great article. Good insights and reflections.

Thanks

MG seems to be changing/updating its models too often (MG3 excepted) which may affect residual values. Despite good sales in the UK it has surprisingly been voted the worst brand out of 25 to represent by dealers due to poor aftermarket service and access to senior management, etc – it presumably needs to sort out its customer support over the whole life cycle.

Interesting info, I wasn’t aware of that about the dealers. Communications and vision always seem to have been a problem with the brand since Chinese ownership.

Treated as a stepchild from the onset with SAIC, it needs to moved up notches in the organization’s priority.

After all, without “MG” badging some of those Roewe models would not have a chance.