The Chinese automotive market experienced a notable fluctuation, with new car sales totaling 2.03 million units in January 2024, according to data released by the China Passenger Car Association (CPCA). This figure represents a year-on-year increase of 57.4% and a month-on-month decrease of 13.9%.

The decline from December 2023 to January 2024 can be attributed to automakers’ reduced discounting activities, which had been aggressively pursued in the final month of 2023 to meet annual sales targets.

The New Energy Vehicle (NEV) sector, encompassing both electric vehicles (EVs) and plug-in hybrid electric vehicles (PHEVs), continued to exhibit stable growth amidst the market’s recovery, contributing to 33.8% of the total vehicle sales in January 2024. EV sales stood at 396,000 units, while PHEV sales reached 291,000 units.

It’s worth noting that January 2023 and February 2024 traditionally mark the Chinese New Year, which results in lower sales due to factory and retail store closures. This seasonal change tends to affect sales figures, making performance in January 2024 stronger than January 2023. As a result, the overall sales volume of the market this month increased by more than 50% year-on-year, and the top 10 sales brands are all growing.

Note: The sales data in this article come from CPCA: CPCA’s statistical basis is the retail sales of passenger cars produced in China. Sales data do not include imported cars and commercial models. Brand sales do not include sub-brands.

Market Dominance and Brand Rankings

Volkswagen took the lead with an impressive sale of 209,476 units in December 2023, achieving a year-on-year growth of 41.5% and claiming a market share of 10.29%. This made it the only brand to exceed a 10% market share for the month, overtaking BYD, which had consistently held the number one spot for eleven consecutive months.

BYD, not far behind, ranked second with sales amounting to 191,122 units, marking a 43.4% increase from the previous year and securing a 9.39% market share.

Toyota followed in third place, with sales reaching 141,689 units, up by 35.1% year-on-year, resulting in a 6.96% market share. Changan and Wuling completed the top five, with sales of 130,408 and 129,638 units, respectively.

BYD’s dominance in the NEV sector remains unchallenged, leading the EV and PHEV markets with significant shares. The brand held a 26% market share in China’s EV market and an even more dominant 34% share in the PHEV category for the month.

Pure Electric Vehicle Market

In the pure electric vehicle segment, BYD continued its leadership with sales of 98,423 units, capturing a 26.18% market share. Tesla, with sales of 39,881 units, ranked second, achieving a 10.61% market share in the EV category.

Top Car Models

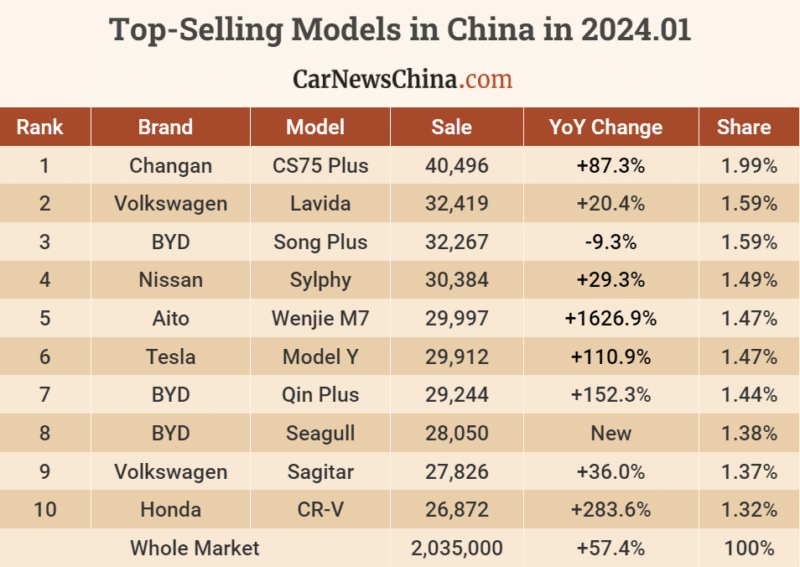

The top-selling models in the Chinese market for the month were Changan’s CS75Plus, leading with 40,496 units, followed by Volkswagen’s Lavida with 32,419 units, and BYD’s Song Plus closely behind with 32,267 units sold.