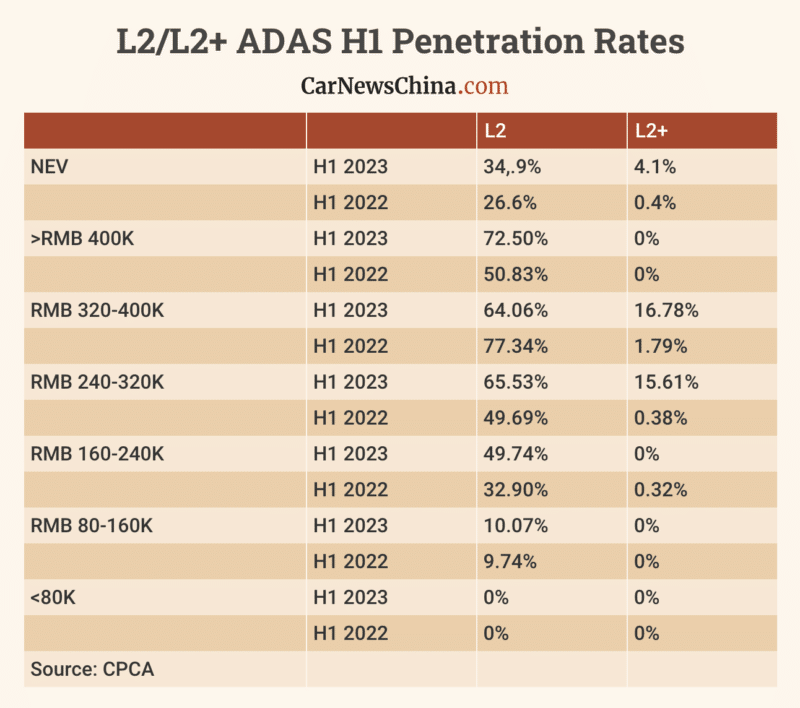

Over a third of new energy vehicles (NEV) in China offer partially automated driving or L2 ADAS, a survey by China Passenger Car Association (CPCA) shows. 34.9% of electric vehicles (EV) and plug-in hybrids sold in China in the first half of the year offered L2, 8.3 percentage points higher compared to the last year. Higher levels of automation recorded an impressive increase to 4.9% from 0.4% last year. At the same time, 18.1% of internal combustion engine vehicles (ICEV) offered L2 ADAS, up 6.6 percentage points compared to the first six months of the last year.

L2 becoming a standard in high-end segment

The highest L2 penetration rates were recorded among vehicles with a price tag over 160,000 yuan (USD 22,000). The NEVs with 400,000+ yuan price tag saw almost 75% penetration rate this year, while the second highest penetration rate was seen in 240,000-320,000 yuan segment (USD 33,000-44,000). Interestingly, 320,000-400,000 yuan segment saw a decrease in L2 penetration rate, but that was due to increasing share of L2+ ADAS in the segment, which increased to 15.61% from 0.88% last year. The highest L2+ rate was found in 320,000-400,000 yuan segment at 16.78%. None of the NEVs sold for 80,000 yuan (USD 11,000) or less offered L2.

Emergency breaking and cruise control gaining ground

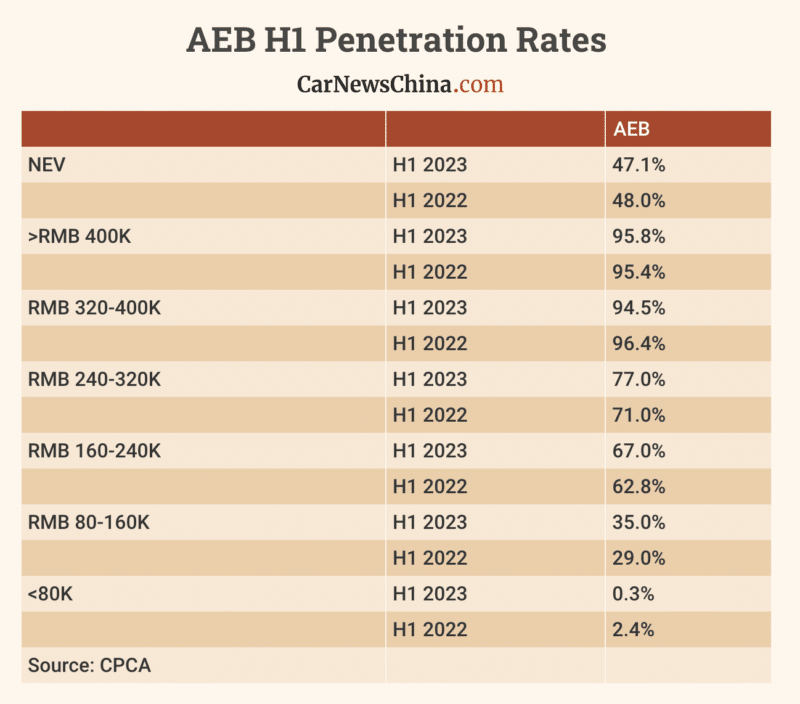

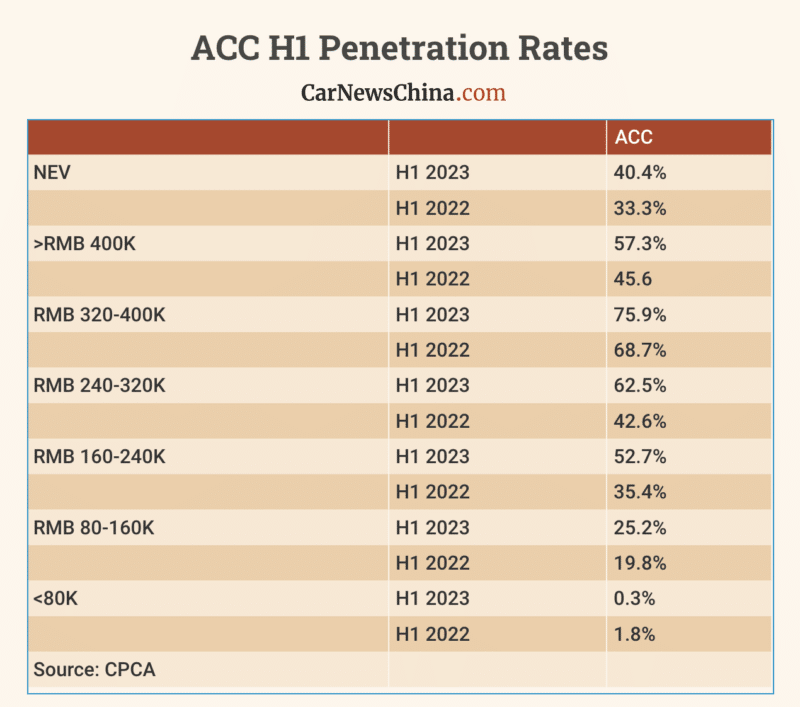

The survey of L2 functions among the NEVs sold in the first six months of the year, showed automated emergency breaking (AEB) and automated cruise control (ACC) being installed in over half of the cars. ICEVs showed below 50% rates.

AEB reached almost 100% penetration in the segments above 240,000 yuan (USD 33,000), while the NEVs sold for over 160,000 yuan (USD 25,000) did not lag much with nearly 75% penetration. The cost of L2 ADAS was the major obstacle for higher penetration among cars sold for less than 160,000 yuan. ACC followed the similar pattern.

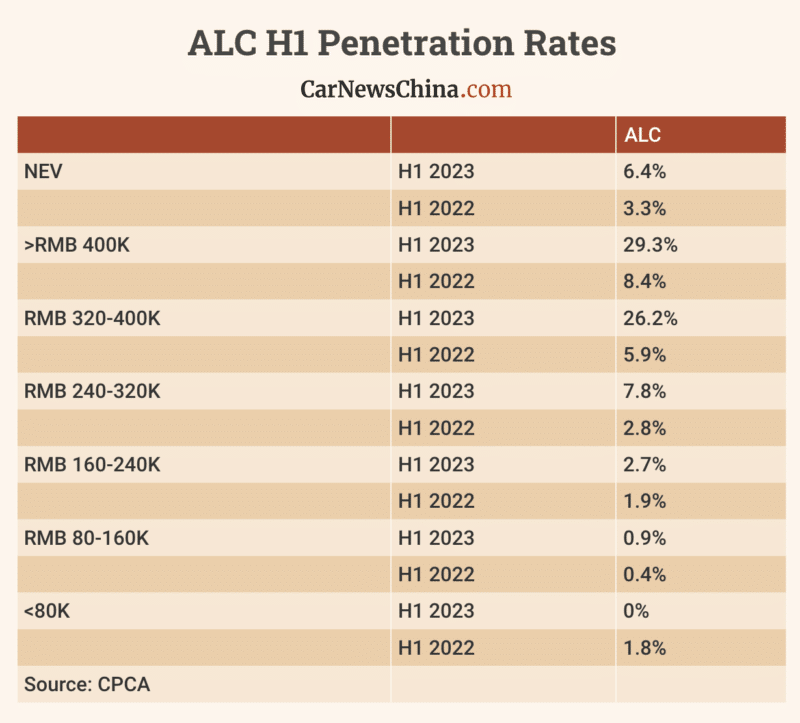

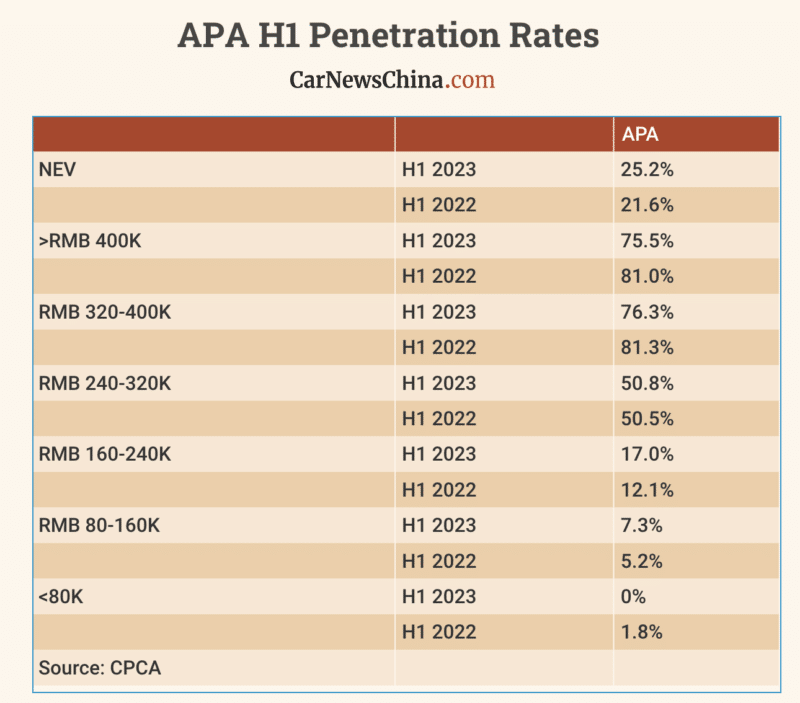

While AEB and ACC are becoming a standard in high-end and mid-end segment, automated line change (ALC) and automated parking assist (APA) are currently concentrated in the luxury segment. ALC’s overall penetration rate among NEVs was 15.9% with the highest rates in above 320,000 yuan segment, which saw 60%-70% rates among the cars sold prior July. APA recorded a bit higher general rate at 35.7%, but has shown the same pattern with the most APAs being installed in the luxury segment above 320,000 yuan.

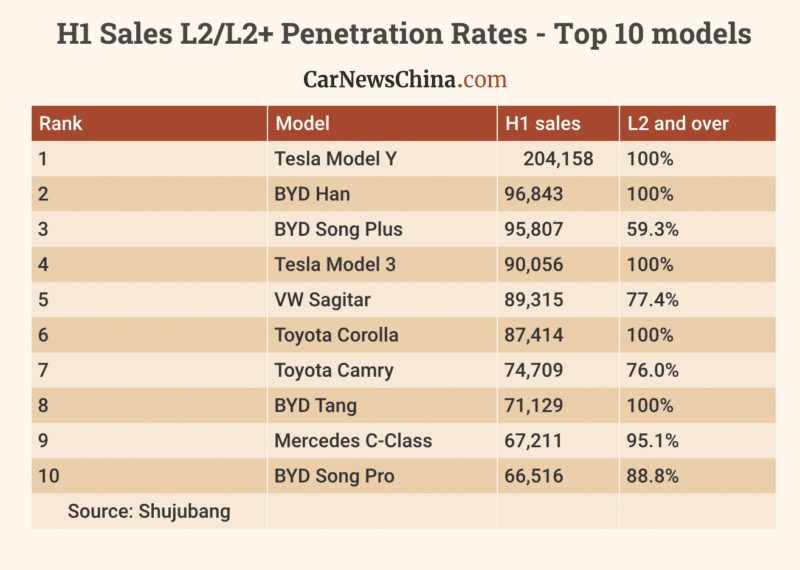

Half of H1 bestsellers had 100% L2 penetration rate

Based on an other survey by Shujubang, auto data service provider, among the top 20 most sold models in the first half of the year, ten of them had a 100% L2 penetration rate and two over 90%. Among top 3, Tesla Model Y and BYD Han had 100% rates, while BYD Song Plus was at 59.3% penetration rate.