Last week we saw how GAC replaced an unwilling joint venture partner with a more promising one and reorganized its business structure. It also took the first steps towards a self-owned car brand, but before we get to that, first we’ll take a look at GAC’s other joint venture partners. GAC added a few international brands to its portfolio and also dabbled with some domestic car manufacturers.

Japanese competition

After exchanging Peugeot with Honda, GAC experienced for the first time what great commercial success tastes like. It opened the door for more joint ventures, now that GAC had become a credible partner to international manufacturers. Surprisingly, GAC turned to Honda’s main competitor for its second joint venture project, namely Toyota.

Toyota’s ascend in the Chinese market had been very cautious, maybe even slow. They were a late entry to local production, creating their first joint venture with Tianjin Automobile in 2000. Of course, Toyota had already some technical cooperation with several small Chinese manufacturers, but these were mostly for commercial vehicles. Think of the Jinbei vans, for instance. Tianjin merged into FAW in 2003, which strengthened Toyota’s position in the Chinese market and the Japanese saw room for another joint venture.

While FAW-Tianjin-Toyota mostly concentrated on smaller vehicles like the Vios and Corolla, the GAC-Toyota joint venture, which was established after long negotiations in 2004, first produced the Camry model. Again an interesting choice, because the Camry is, of course, a direct competitor to the Honda Accord, made by GAC-Honda. A big battle emerged between the Accord and Camry for the top spot in the sales charts, surpassing the VW Passat and Nissan Teana in the process. The top spot went back and forth a few times.

GAC-Toyota’s second car became the Yaris in 2006, related to the FAW-Toyota Vios. The Yaris however failed to capture the heart of the Chinese buyer. Its soft, curvy looks were too feminine and the car was significantly more expensive than most of the competition. Toyota held higher hopes for its third offering, the Highlander. This was a Camry-sized SUV, deemed to be much more advanced than the generic Chinese SUVs that dominated the segment in 2009.

In 2008 and 2009 the brand encountered some unexpected difficulties in the marketplace. First, the Camry was hit with brake failure. The main brake cylinder could start to leak, reducing the brake force. Although this was a clear safety problem, Toyota’s response was clearly lacking. Instead of issuing a nationwide recall, the company relied on its regular service intervals to spot potential problems and rectify them only when they appeared. While the problem gained traction in the media, Toyota’s corporate image of technical reliability and excellent customer care took a hit and it forced a recall after all. While Toyota replaced the master cylinder on all the Camry’s it had produced in China, the Honda Accord regained the lead in sales charts.

A second problem emerged when a man took his brand new Highlander for a ride on some dirt roads in the country site. He and his friends encountered a fairly steep incline and while his friends’ cars all made it to the top, the Toyota failed to get up the hill. It was first reported in the local news but got national attention when a TV station took the Highlander for a test drive on that hill. They found out that the car indeed didn’t make it to the top, unless it took a long run-up and negotiated the incline at speed. Toyota didn’t respond to the incident, which then turned slightly farcical when people tried (and succeeded) to get up the hill in supercheap minicars like the Chery QQ.

The two incidents affected GAC-Toyota and Toyota sales, but in the end, the effects were short-lived. Toyota pressed on with the E’Z (Verso MPV), a major facelift for the Yaris and a new generation of the Camry. The large saloon also gained a hybrid option. By the end of 2011, the turmoil of the late 2010s was largely forgotten.

A new generation of the Yaris arrived in 2013 and more importantly, a year later GAC-Toyota started manufacturing the Levin as well. The Levin is of course a rebadged version of the Corolla, that was already in production with FAW-Toyota. By then, the line-up of GAC-Toyota and FAW-Toyota largely overlapped and that strategy continues until today. Both joint ventures make mostly the same cars, albeit under different model names and commercialized through different sales channels. Most of the larger international brands with more than one joint venture practice this strategy nowadays.

Toyota renewed the Highlander in 2015, this model being the only SUV in the GAC-Toyota line-up. It would stay that way until 2018 when Toyota added the C-HR. After that, the SUV line-up quickly expanded. The Wildlander (RAV4) arrived in 2020, followed by another new Highlander in 2021 and the Venza (RAV4 Coupe) and Frontlander (Corolla Cross) in 2022. In between, Toyota also introduced new generations of the Camry and Levin (adding a long-wheelbase version called Levin GT). After a four-year hiatus, following the discontinuation of the E’Z, Toyota re-entered the MPV segment with the Sienna in 2021.

Toyota’s electrification effort has always concentrated on hybrid vehicles since they pioneered that type of car in the late 1990s. For the most part, this also holds for China, although hybridization went a bit slower than in the EU or US. But today, Toyota offers a hybrid option on all of its cars, except the Yaris. China does have some specific regulations about electrified vehicles though, including the need to gather some NEV regulatory credits. These NEV credits are only available for BEVs, PHEVs, or fuel-cell vehicles. If a manufacturer doesn’t generate them itself, they must buy them from others or face a fine from Beijing.

So Toyota needed to put some effort into electric cars and the first attempt was creating a sub-brand called Lingzhi (or Leahead in English, which stood for Leap Ahead). I’ve covered this brand in an earlier article and it produced only one car in 2015: the Leahead i1, an electric Yaris. GAC-Toyota sold a couple of dozen. When the NEV credits really started to become a problem, Toyota did the same as Honda: rebadged GAC cars. They rebadged the exact same cars, the Trumpchi GS4 and the Aion S. Although initially announced as Lingzhi again, these cars sell or sold as GAC-Toyota.

Toyota also converted the C-HR to a BEV. This was the usual ‘aftermarket’ conversion, with a battery pack bolted below the floor of the car. Early Chinese EV makers did that years before, but the C-HR BEV appeared in 2019. It was sold by FAW-Toyota as well, as the Izoa. Both cars have been discontinued in favor of Toyota’s real electric car, the bZ4X. Now this car has experienced a very troublesome global debut, with a 4-month production break due to problems with wheels and airbags, and following that, very critical test reports from several media about low range and slow charging.

How all the bad news will affect the Chinese sales of the bZ4X remains to be seen. Toyota however, has a backup strategy. In April 2020, the Japanese formed a new joint venture with electric powerhouse BYD, called BYD Toyota EV Technology. It’s not a car manufacturer, but a R&D company. It means BYD Toyota will develop and design Toyota BEVs for China. The first car has just been released and is called bZ3. It’s a mid-size sedan, based on Toyota’s e-TNGA platform, but with a complete drive train and battery from BYD. Toyota wants it to become the “electric Corolla”, so it’s surely an important car.

The Japanese brand is doing very well in the Chinese market. It seems relatively unaffected by the global supply issues troubling the industry post-covid and it slowly moves in on Volkswagen for the top spot in the sales charts. The only obstacle in the way of dethroning the Germans is Toyota’s electric partner. BYD might just pass both before Toyota can claim the crown.

Ciao Italia

Fiat was quite successful in China with commercial vehicles (Iveco) and agricultural tractors (New Holland), but passenger cars? Not so much. The Italians had a joint venture with Nanjing Automobile since 1999 and produced a range of cars based on the Palio series. This design sold quite well in many developing countries, but in China, the 100,000-vehicle factory only made 30.000 or so cars per year. In 2006 Nanjing Auto acquired the remains of MG Rover and Fiat believed their partner became distracted. In 2007, just before Nanjing Auto and SAIC merged, Fiat withdrew from the joint venture.

Instead, Fiat turned to Chery Automobile. In the summer of 2007, both brands announced a joint venture for the production of Alfa Romeo cars, the 147 and 159, and an engine project led by Chery. There were documents signed, but these were declarations of intent. Not much later, GAC approached Fiat about its new self-developed brand. GAC was looking for some technology transfer to get things rolling quickly and Fiat sold them the production line and platform from the Alfa Romeo 166, which had just been taken out of production.

Apparently, one thing led to another and in March 2009, Fiat called off the proposed joint venture with Chery. The Italians cited economic reasons, as the global credit crisis had just broken out. Just three months later they signed on to a joint venture with GAC instead, and construction of a new factory started in Changsha, Hunan province, in late November. It would take until the summer of 2012 for the factory to be finished.

Meanwhile, interesting developments were taking place elsewhere. In the US, Chrysler Corporation got in trouble during the credit crisis and Fiat participated in preventing bankruptcy. In 2009 the Italians acquired 20% of the Chrysler shares, which rose to 59% in 2012 and in January 2014, they were allowed to wholly acquire the American automaker. The new global company was revamped Fiat Chrysler Automobiles (FCA).

A slightly restyled Dodge Dart thus became the first Chinese Fiat, called Viaggio. The Dodge in turn was the sedan version of the Alfa Romeo Giulietta hatchback. The car came with modern T-Jet engines and optional DCT transmission. In 2014, Fiat also launched a hatchback version of the car, called Ottimo. Both models were sold until 2017 and were the only two Fiat-labeled products by GAC-FCA.

The company saw better opportunities by bringing back an iconic name in Chinese car history: the Jeep Cherokee. The Cherokee had been produced by Beijing Jeep for many years and was a well-known sight on the streets. GAC-FCA’s Cherokee was of course a much more modern generation and appeared in 2015. A year later, GAC-FCA added the smaller Renegade and Compass models, switching the line-up entirely to Jeep. The model range was completed by the large Grand Commander in 2018.

GAC-FCA’s bet on the Jeep name paid off handsomely. Car production rose to over 200.000 vehicles in 2017, but that proved to be the best year of the joint venture. The way down took a little longer than the way up, but in 2021, Jeep only sold just over 20.000 cars. You’ve probably noticed that my fellow writers on this website have mentioned a booming outdoor lifestyle hype in China, ever since covid hit the country. And what brand would you associate with that lifestyle? Yes, Jeep. But instead, the Chinese buyers flocked to pickups and all-wheel drive SUVs from domestic manufacturers.

Developments overseas once again determined the fate of the joint venture. In 2020, FCA and PSA (the Peugeot company from France) entered into merger negotiations. The process was completed in January 2021, and the combined company would be known as Stellantis. Former Peugeot CEO Carlos Tavares was put in charge. In the West, the merger was seen as the creation of a strong global player in the car industry, but its operations in China were problematic. GAC-FCA was in decline and also the Dongfeng-PSA joint venture was just a shade of their former glory.

Tavares is not a man known for subtlety. Early in 2022, he said Stellantis would raise its stake in GAC-FCA to 75%. For the GAC directors, this announcement came out of blue air and they were not amused. What followed was months of arm wrestling and bickering. Production at the joint venture was halted in July. Both parties couldn’t come to an agreement and in October, GAC-FCA was put up for bankruptcy. In a case of history repeating, Peugeot (well, Stellantis) managed to run a GAC joint venture into the ground. Again.

Diamonds are not forever

While GAC prepared for the launch of its self-owned car brand, the company interacted with three smaller domestic car manufacturers. I already mentioned Changfeng Automobile last week, in the description of GAC’s transition process. In 2012, GAC wholly acquired Changfeng and the joint venture with Mitsubishi the small brand had. GAC detached Changfeng and Mitsubishi and formed a joint venture with the Japanese brand themselves. In September 2012, GAC (50%), Mitsubishi Motors (30%), and Mitsubishi Corporation (20%) finalized the contracts.

During the transition period, the Pajero model was the only Mitsubishi-branded car in production, but it disappeared shortly after. Despite the reasonable success of the Pajero, GAC Mitsubishi had different plans. Instead, the company put the Mitsubishi ASX into production, a compact SUV replacing the large off-roader. This proved to be a wise move, production doubled from 30.000 to 60.000 cars. In 2017, when GAC-Mitsubishi had just launched the Outlander model, production doubled again. In the next two years, the joint venture enjoyed its glory days with sales numbers of around 140.000 cars.

Mitsubishi also had a Chinese joint venture with Fujian Motors at the time. The product line-up was nicely separated: Fujian Mitsubishi produced sedan cars, mostly Lancer-based models, and MPVs, while GAC-Mitsubishi made the SUVs. The ASX is still in production today, after numerous refreshments and facelifts. But the old car can’t hide its age and its appeal has diminished in the last couple of years. So the Outlander accounts for most of the sales, still only half of the best years. In an attempt to turn the downward trend, Mitsubishi has added the Eclipse Cross to the line-up, and a new generation Outlander will follow soon.

Mitsubishi Motors got in trouble in the home market, when it was revealed that the company had cheated on emission and fuel economy tests for years. It got so bad, that Mitsubishi had to be saved by Nissan, who took a controlling share. Later almost all other Japanese brands were caught for similar offenses, but Mitsubishi suffered the most. Nissan didn’t inherit a thriving brand. Mitsubishi had been known for sensible, reliable, and affordable cars for years, but well-known nameplates like Colt, Lancer, or Galant were fading in the market. The Pajero was gone and the rally successes of the Lancer seemed forgotten. Mitsubishi survived on a range of Kei-cars in Japan, low-budget MPVs in South-East Asia, and some moderately successful SUVs elsewhere. In 2020, Nissan decided that all future models would share technology with Nissan cars. The new Outlander is derived from the Nissan Rogue/X-Trail.

Mitsubishi sold the Outlander PHEV quite well in some markets, but not in China. The brand’s electrification efforts followed the example of Honda and Toyota. Create a sub-brand and rebadged some GAC Trumpchi cars. Mitsubishi’s sub-brand was Qizhi (Eupheme in English) and like Honda and Toyota, it rebadged the Trumpchi GS4 as Qizhi PHEV. Qizhi didn’t electrify one of its own gas cars but rebadged the Trumpchi GE3 (a small hatchback and predecessor of the Aion brand) as Qizhi EV. I can’t find if Qizhi’s actually sold, but if they did, then just in small numbers. The brand disappeared again in 2020.

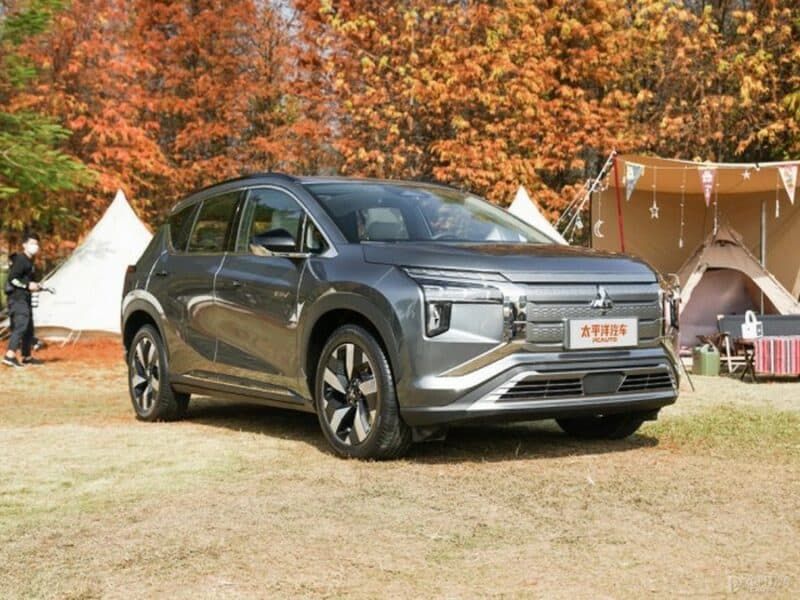

To remain relevant in the Chinese market, Mitsubishi developed a China-only model. Again, GAC Aion technology underpinned the car, in this case, the platform and drive train of the Aion V-series. But in contrast to the Qizhi effort, this time Mitsubishi designed its own body. This Airtrek has similar dimensions as the Outlander but comes as BEV only. The car went on sale in January 2022 but hasn’t found 1.000 buyers yet.

In a turn from bad to worse, the diamond-logoed brand announced a suspension of production earlier this year. Initially, it was announced for a few weeks, ending in May. However, May has come and gone and the production suspension is extended, indefinitely. Mitsubishi officials have said that they are not planning to leave the Chinese market, but the future looks very difficult at least.

Next week

The final episode of this series on GAC will deal with the company’s self-owned car brands Trumpchi, Aion, and Hycan.

Very good read.

But are not Gonow, and Zhongxing (ZX Auto), as joint venture partners, not worth mentioning?

GAC drew them in, but then squashed them , like it did Changfeng in the case you mentioned.

Perhaps with the coveted Honda and Toyota partnerships assured, those others were of no account.

Don’t worry, there’s one more episode to come in this series…. 😉

Thank you Leo. Will be patient.. ,since your articles are always worth the wait.

Also of note was a tie up with Chery, to do joint R&D back in 2013. That apparently was short lived as well.