In an exclusive report, local media 36kr informed that CATL would install sodium-ion batteries into the first EVs in the fourth quarter of the year, while BYD will start mass production of sodium-ion packs in the second half and install them on BYD Seagull and other Ocean series models. 36kr media is something like ‘Chinese TechCrunch.’

Both companies will mix lithium-ion and sodium-ion batteries under newly developed BMS in their new mass-produced batteries.

CATL’s sodium-ion battery is set to be incorporated into the initial model of Chery’s iCAR brand of new energy vehicles (NEVs). Chery announced this at their conference last week, but the launch in Q4 is further information. 36kr report also says that sodium ion will be used on Chery’s budget EVs, such as QQ Ice Cream.

Sodium-ion batteries are alternatives to LFP and NMC batteries to ease the dependence on lithium. Its price continued to rise last two years and, at its peak, exceeded 600,000 yuan/ton (87,200 USD).

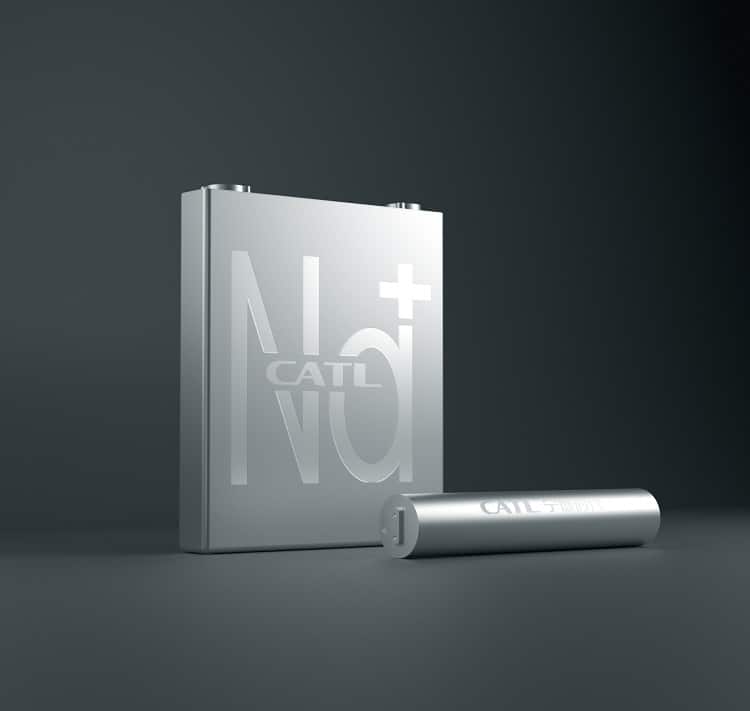

CATL & Sodium-ion

In July 2021, CATL revealed its sodium-ion batteries which possess an energy density of 160Wh/kg, a slightly lower value than LFP batteries. However, these batteries offer certain advantages, such as more cost-effective manufacturing, superior performance in low temperatures, and enhanced safety features. Furthermore, CATL shared that their upcoming sodium-ion batteries, with improved energy density surpassing 200 Wh/kg, will commence mass production by 2023. Common LFP batteries have an energy density of about 90 – 160 Wh/kg.

CATL first-generation sodium-ion cells cost about 77 USD per kWh, and the second generation with volume production can drop to 40 USD per kWh.

In present times, it appears reasonable to utilize sodium-ion batteries in electric vehicles. However, this was not an obvious choice back in 2021 when even CATL believed that sodium-ion batteries would mainly be suitable for energy storage and two-wheeled scooters. Some analysts in China went as far as speculating that the CATL sodium-ion battery initiative was only meant to exert pressure on lithium suppliers to lower the prices.

Nevertheless, the progress in developing sodium-ion batteries surpassed expectations, while lithium prices continued to surge throughout 2022. As a result, it became increasingly evident that utilizing sodium-ion batteries in electric vehicles was inevitable. In November 2022, CATL confirmed this development, announcing that their sodium-ion batteries are anticipated to power electric vehicles.

BYD & Sodium-ion

There are others besides CATL who are driving the advancement of sodium-ion batteries. Last December, BYD announced their plans to commence mass production in 2023 and introduce a compact electric hatchback powered by a sodium-ion battery pack. CarNewsChina reported that this car is most likely to be the BYD Seagull, which was launched two days ago at Shanghai Auto Show. However, without the sodium-ion battery pack option. 36kr report now reveals that the Seagull variant with sodium-in will come in the second half of the year, and it should have a 305 km CLTC range. The Seagull price starts at about 80,000 yuan (11,600 USD).

Battery hegemony

As per SNE research, CATL is the largest battery manufacturer in the world, commanding a global market share of 37% in 2022. LG and BYD follow with 13.6% each. Virtually all notable electric vehicle manufacturers are clients of CATL, which includes Tesla, Volkswagen, Nissan, Nio, and Tata. Moreover, CATL is also an integral part of the recently constructed Ford battery plant in the United States.

Benefits of sodium-ion batteries:

- Safer than lithium batteries

- Better ability to withstand cold temperatures

- Slower discharge rate

- Cheaper to produce

- Better for the environment

But there are still some disadvantages:

- Slower charge rate

- Lower attainable voltage

- Lower energy density

Perfect knowledge CNC. We will bring it to those who doesn’t know or understand.This was a simple, clear information. Thank you Jiri!

You should really correct the energy density of LFP, those numbers are dead wrong. LFP can reach 180 Wh/kg, not 280-350. That is for NMC and the upper limit only with an Anode Chemistry that includes Silicon.

You are right Michael, thanks, it is fixed. I got blowned away by some nonsense forecasts. 90 – 160 Wh/kg seems reasonable for LFP. 280 – 350 might be too much even for NMC.

Anyway, now the recently announced 500 Wh/kg from CATL sounds even more breaking.