The top ten automakers in China by retail sales in August were BYD, FAW-Volkswagen, SAIC Volkswagen, SAIC-GM, Changan, Geely, Dongfeng Nissan, GAC Toyota, FAW-Toyota, and Chery, according to the China Passenger Car Association (CPCA).

FAW-Volkswagen is the best performer among the joint venture brands with the retail sales volume reaching 164,000 units, a year-on-year increase of 38.1%. As for the third-ranked SAIC Volkswagen, compared with BYD and FAW-Volkswagen, the gap is larger, with sales of only 118,000 units, an increase of only 5.6% year-on-year.

Changan, BYD, Chery, and Geely all achieved positive year-on-year growth among the Chinese independent brands. The market share of independent brands reached 45.8%, a year-on-year increase of 3.8%, which corresponds to a total sales volume of 850,000 units, a year-on-year increase of 41%.

On the contrary, the joint venture brands’ total sales volume in August was only 770,000 units, a year-on-year growth of 18%, and its market share fell to 41.1%. Among the major joint venture brands, the market shares of German, Japanese and American brands are gradually declining. The retail market share of German brands in August was 21.1%, a year-on-year decrease of 1.1%. The retail market share of Japanese brands was 20.7%, a year-on-year decrease of 1.2%. The retail market share of American brands was only 8.9%, a year-on-year decrease of 0.4%.

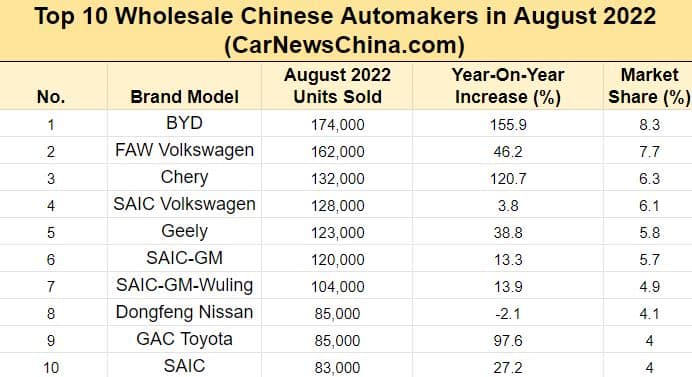

The top ten automaker brands in China by wholesales in August were BYD, FAW-Volkswagen, Chery, SAIC Volkswagen, Geely, SAIC-GM, SAIC-GM-Wuling, Dongfeng Nissan, GAC Toyota, and SAIC, according to CPCA.

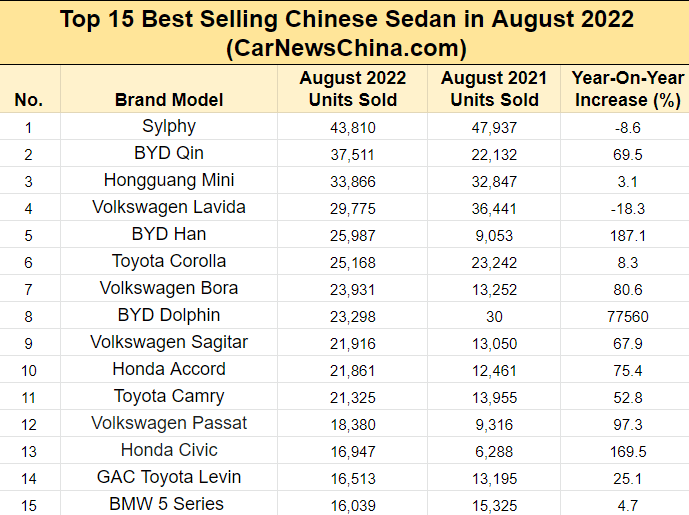

Furthermore, 949,000 units of Chinse sedans were sold in August, a year-on-year increase of 29.2% and a month-on-month increase of 5.1%. The cumulative sales from January to August were 6.438 million units, a year-on-year increase of 2.2%.

Sum Up

August 2022 was one of the hottest summer months in Chinese history. The extreme heat led to a significant drop in the number of customers visiting dealerships in China. Fortunately, automotive supply chains are slowly bouncing back compared to pre-pandemic levels, which contributes to the increased vehicle production.

About CPCA

CPCA is a non-governmental organization established in 1994 by SAIC Volkswagen and several other sedan manufacturers. Its original name was the National Sedan Market Data Fellowship Society. It is not qualified for automotive statistics or authorized by the government to gather and publish automotive statistical data. It is merely a data exchange platform between automotive companies by collecting data from the reports submitted by these companies.

A 29.2% year on year increase in sedan sales makes China an outlier in the major markets, but I’m glad to see this trend. The trend is reflected in other Asian markets as well, while we go sedan-free in the U.S

market. The Tesla Model 3 being the major exception.